Many companies in B2B sales are looking for more growth in their respective market segments; however, their sales and business leaders are still looking at their markets as whole segments rather than seeing and seizing the lucrative opportunities that micro segmentation can bring.

Without effective micro-segmentation, businesses risk missing niche or unique opportunities and/or needlessly increasing the cost of sales across the segment as a whole. To micro-segment a market effectively, you need to consider (at both the macro and micro levels) the size of each sales segment and the purchasing drivers of relevant customers. From there, you can more easily determine which markets (or micro-segments) are most likely to grow. You will also need to determine the points at which market dynamics shift (or are likely to shift), and whether your sales team will be able to work effectively in their market(s).

Along with the above, there are five main considerations that are important for ensuring effective micro-segmentation.

-

Define Sales Segment Size

Determine the optimal size for each sales territory, whether they be defined by geography, demographics or business activity of the prospects, or some unique combination of these. You will also need to determine the boundaries of these segments—whether there is likely to be overlap between segments, or any movement of people between segments. Finally, ensure that your sales people will be able to serve the micro-segment appropriately. Whilst it is important to ensure that the segments are determined by market characteristics, and not by arbitrary or convenience means, from a strategic position it is also important to ensure that your business is capable of effectively covering the segment.

-

Determine growth potential

To gauge the growth potential of each micro-market, determine what drives your prospect/customer purchases. Make a list of 10 to 15 customer drivers. Use industry knowledge, customer feedback, information from salespeople, other relevant trends and informed hypotheses to build out this list. Drivers might include continuity of supply, environmental impact, funding, quality, design, reliability, reputation & brand, cost of inputs, cost of capital, local demographics, and so on.

-

Gauge market share

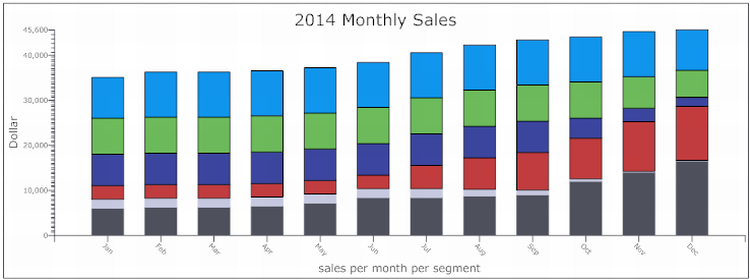

Use sales data to determine the market share for each micro-segment, particularly revenues and margins across product/service lines of business. If possible, also look at trends in sales across these micro-segments for the last two-three quarters (or years for seasonal markets). Has your market share changed over this time or remained stable?

-

Identify the Causes of Differences in Market Share

Determine the variations in your market share both within and between your micro-segments. Are there any micro-segments that are doing particularly well? Are there any segments that are experiencing substantial growth or loss?

Additionally, collect any internal and external data on marketing and sales activities that could affect market share. These could include salesperson coverage and performance, data for any partners in each market, marketing spend, and pricing information.

You will then need to identify the main causes of low market share, particularly in any high-growth-potential micro-markets. Things like low salesperson coverage or low marketing spend in these segments can lend themselves to the easiest fixes, whereas more complex causes of low market share (e.g. shifting demographics) will in turn require a more complex solution.

-

Prioritise Growth Pockets

Understanding the root causes of market share variance and/or segments with low market share will allow you to better prioritise which micro-markets to focus on. For example, you may want to direct resources to areas which can be easily addressed (such as poor salesperson coverage), rather than focus on micro-segments that are potentially difficult or costly to address (such as uncompetitive pricing).

Prioritising micro-markets is an iterative exercise, it needs regular reviewing and reworking and should ideally involve both executives and sales managers in both the analysis and prioritisation processes. Additionally, sales managers should have the flexibility to instantly manoeuvre and adjust at the local level, to ensure they are able to respond rapidly to changes in their markets and micro-markets.

If you want help in analysing the effectiveness of your current market segments, please contact us and ask about our Market Segmentation Analysis Process.

Remember everybody lives by selling something.

Author: Sue Barrett, www.barrett.com.au

Sue Barrett is the founder and CEO of the innovative and forward thinking sales advisory and education firm, Barrett and the online sales education & resource platform www.salesessentials.com. Sue was the first in Australia to get Selling a university qualification and has written more than 600 blog posts and 21 e-books on sales and with her team produces the ‘must read’ Annual 12 Sales Trends Report. Helping people and businesses sell better, Sue is a Sales Philosopher, Activist, Strategist, Speaker, Trainer and Adviser. Get to know her further on Twitter, Facebook, and Youtube.

If you valued this article, please hit the ‘like’ button and also share via your Twitter, LinkedIn, Google+ and Facebook social media platforms. You are welcome to join the conversation or ask questions so feel free to add a comment on this post.

New Article Email Notification